call us now 03330 150335

Our purpose is simple: to help people and organisations use their money as a force for good. We exist to help make sustainable, values-aligned financial planning the norm, not the exception.

Across the UK, trillions of pounds sit in pensions and investments that most people know little about. Many of these funds support industries that harm the planet, widen inequality, or work against the values of the very people who own them. We believe this a problem worth solving.

Our mission is to help people understand not just how their money is invested, but what it supports. We do this by combining expert, independent financial advice with access to award winning, sustainable, impact-aligned, affordable investment options. This delivers both strong financial outcomes and measurable positive impact.

We believe financial wellbeing and planetary wellbeing are connected. By helping people make informed, ethical choices, we enable them to grow their wealth, support a fairer economy, and contribute to tackling the climate and nature crises.

Greenspace is proud to be Certified B Corporation, part of a global movement of companies using business as a force for good. B Corps are independently verified to meet the highest standards of social and environmental performance, transparency, and accountability.

Certification is proof that we are serious about change. It means that every decision we make, from how we invest, to how we treat our people, clients, and partners (all of our stakeholders) must balance profit with purpose. It holds us legally accountable for considering our impact on society and the environment.

We believe financial advice can and should be a positive force in the world. Being a B Corp ensures that this belief is hard-wired into our governance and day-to-day practices. It means we measure what matters, report on our progress, and continually improve.

Every three years we are re-assessed to confirm that our standards remain among the best in the world for responsible business. This ensures that doing good for people and planet is never just a slogan.

Find out more about the B Corp movement here.

We provide clear, expert financial advice to individuals, businesses and organisations, including workplace pension schemes. It starts with a simple, free consultation. We’ll get to know you, your values, concerns, current financial picture and your future hopes. We’ll answer your questions, and you will then be able to decide your next steps.

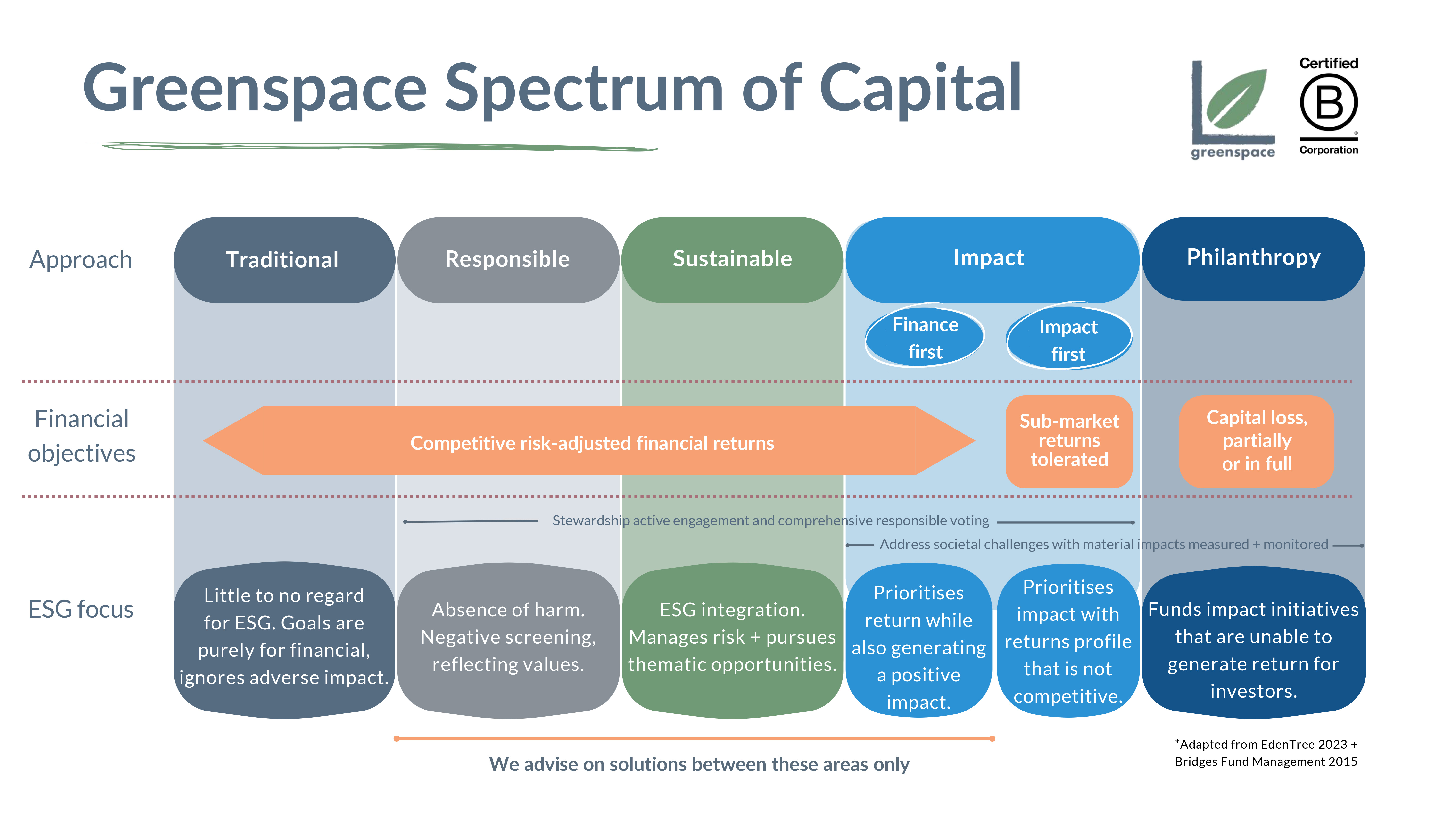

As well as your objectives around performance, costs and risk, our advice process is guided by the Spectrum of Capital. This is a framework that ranges from traditional investing through to responsible, sustainable, and fully impact-focused options. Wherever you sit on that spectrum, we’ll help you find the balance that feels right for you or your organisation.

Once your strategy is agreed, we take care of the implementation and keep things under review, so your advice and investments stay suitable as life and markets change. Whether you’re an individual client, a business owner or an employer, we’ll help you make confident financial decisions that deliver strong results and a positive impact.

Marc is an expert in sustainable and positive impact financial advice. He is responsible for the compliance and regulatory functions of Greenspace as well as being company director and chairing the investment committee. Beyond finance, he is a husband and father, an active community member and experienced hiker. Marc enjoys reading and philosophy, in particular taking a keen interest in the future of economics, and how technological developments will shape our world.

Dan is an experienced financial adviser and investment manager who has specialised in positive impact and sustainable investing since 2008. He advises private clients, businesses, investment committees, and charities on aligning finance with values. Dan is the founder and co-founder of several purpose-driven B Corporations. Beyond finance, he serves as a charity trustee and is an active climate and anti-racism campaigner, followed by over 200,000 people online under a pseudonym.

Greenspace Sustainable Financial Planning Ltd, Cams Hall, Fareham, Hampshire, PO16 8AB

Greenspace Sustainable Financial Planning Limited is authorised and regulated by the Financial Conduct Authority.

FCA number: 927943

Registered in England and Wales: 12466201.

Registered office: 132A Bournemouth Road, Chandler’s Ford, Eastleigh, SO53 3AL

The guidance and/or advice contained within this website is subject to the UK regulatory regime, and is therefore targeted at consumers based in the UK